Travel card 101 answers army – Prepare to embark on an enriching journey as we delve into the world of travel cards for the military community. Our comprehensive guide, Travel Card 101 Answers for the Army, will equip you with the knowledge and insights to navigate the complexities of travel cards, ensuring a seamless and stress-free travel experience.

In this meticulously crafted guide, we’ll explore the fundamentals of travel cards, empowering you with an in-depth understanding of their benefits, types, and features. We’ll delve into security measures, usage tips, and strategies for minimizing fees, leaving no stone unturned in our quest to provide you with the ultimate travel card companion.

Travel Card Basics

Travel cards are financial instruments specifically designed for travelers, offering a convenient and cost-effective way to manage expenses while abroad. They provide numerous benefits, including reduced transaction fees, favorable exchange rates, and added security compared to traditional cash or credit cards.

Various types of travel cards exist, each catering to specific needs and preferences. These include:

- Prepaid Travel Cards:Loadable with a set amount of funds, these cards function like debit cards and do not require credit checks.

- Travel Credit Cards:Similar to regular credit cards, these cards allow you to borrow money for purchases and pay it back later. They often offer rewards and benefits tailored to frequent travelers.

- Currency Exchange Cards:These cards hold multiple currencies, allowing you to switch between them easily at favorable exchange rates.

| Feature | Prepaid Travel Card | Travel Credit Card | Currency Exchange Card |

|---|---|---|---|

| Initial Fees | Variable, typically low | May have annual fees | May have activation fees |

| Transaction Fees | Usually low, may vary by country | May charge foreign transaction fees | Minimal to no fees |

| Exchange Rates | Generally competitive | May not be as favorable as currency exchange cards | Highly competitive |

| Security | Protected by PIN or chip-and-PIN technology | Offer fraud protection and purchase safeguards | Similar to prepaid travel cards |

| Rewards | Limited or no rewards | Often offer rewards such as miles or points | No rewards |

Travel Card Features

Travel cards offer a convenient and secure way to manage your finances while traveling abroad. When choosing a travel card, it’s essential to consider several key features to ensure it meets your specific needs.

The following are some of the most important factors to consider:

Currency Conversion Rates and Fees

Currency conversion rates and fees can significantly impact the cost of using your travel card. Look for cards that offer competitive rates and low fees to minimize your expenses.

The travel card 101 answers army is a valuable resource for travelers. They provide detailed information on everything from how to get the best deals on flights to how to navigate foreign cities. Their website is also a great place to learn about the tragedy of the commons lab , which is a fascinating experiment in human behavior.

The travel card 101 answers army is a great resource for anyone who loves to travel.

ATM Withdrawal Limits and Fees

ATM withdrawal limits and fees vary depending on the card issuer. Choose a card with withdrawal limits that meet your needs and consider any fees associated with using ATMs abroad.

Chip and PIN Technology

Chip and PIN technology provides enhanced security for your travel card. Cards with this feature require you to enter a PIN when making purchases, reducing the risk of fraud.

Mobile App Functionality

Mobile app functionality allows you to manage your travel card account, track expenses, and receive alerts. Choose a card with a user-friendly app that provides the features you need.

Travel Card Security

Travel cards employ robust security measures to safeguard your funds and personal information against fraud and unauthorized access.

To ensure your card’s security, consider the following:

Reporting a Lost or Stolen Card

- Contact your card issuer immediately to report the loss or theft.

- Provide your card number, personal information, and any relevant details.

- The issuer will cancel your card and issue a replacement.

Tips for Safe and Secure Travel Card Use

- Keep your card safe and secure, similar to cash.

- Memorize your PIN and avoid writing it down.

- Use ATMs in well-lit, secure areas.

- Be aware of your surroundings when using your card.

- Monitor your transactions regularly and report any unauthorized activity.

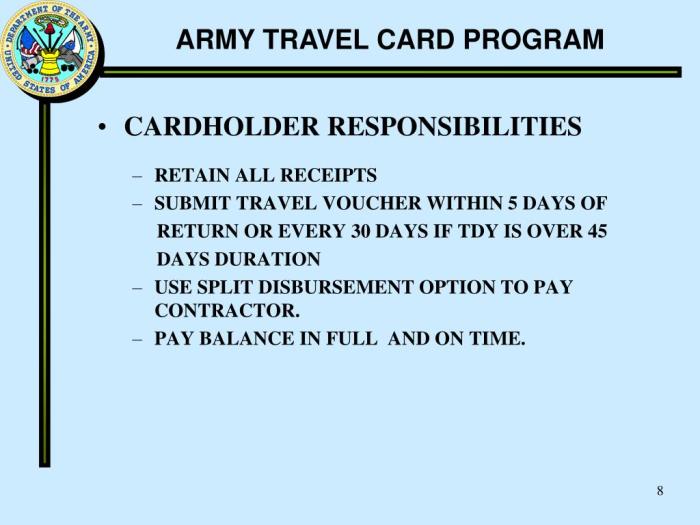

Travel Card Usage: Travel Card 101 Answers Army

Using a travel card is a convenient and secure way to manage your finances while traveling. It can be used for a variety of transactions, including making purchases, withdrawing cash, and paying for transportation. The process of using a travel card is similar to using a debit card, but there are a few key differences to be aware of.

Making Purchases at Retail Stores

To make a purchase at a retail store, simply present your travel card to the cashier and enter your PIN. The cashier will then process the transaction and you will receive a receipt.

Withdrawing Cash from ATMs, Travel card 101 answers army

To withdraw cash from an ATM, insert your travel card into the machine and enter your PIN. You will then be able to select the amount of cash you wish to withdraw. The ATM will dispense the cash and you will receive a receipt.

Paying for Transportation

Travel cards can also be used to pay for transportation, such as buses, trains, and taxis. To do this, simply present your travel card to the driver or conductor and they will process the transaction.

Differences Between Using a Travel Card In-Person Versus Online

There are a few key differences to be aware of when using a travel card in-person versus online. When using your travel card in-person, you will typically need to enter your PIN to complete the transaction. When using your travel card online, you will typically need to enter your CVV code, which is a three- or four-digit security code located on the back of your card.

Travel Card Fees

Travel cards often come with various fees that can add up quickly if not managed carefully. Understanding these fees and implementing strategies to minimize them can help you save money while traveling.

Transaction Fees

Transaction fees are charged when you use your travel card to make purchases. These fees vary depending on the card issuer, the merchant, and the transaction type. For example, some cards charge a percentage of the transaction amount, while others charge a flat fee per transaction.

Currency Conversion Fees

Currency conversion fees are charged when you use your travel card to make purchases in a currency other than the one your card is issued in. These fees can vary widely depending on the card issuer and the exchange rate at the time of the transaction.

ATM Withdrawal Fees

ATM withdrawal fees are charged when you use your travel card to withdraw cash from an ATM. These fees can vary depending on the card issuer, the ATM operator, and the location of the ATM. Some cards offer free ATM withdrawals up to a certain amount, while others charge a fee for each withdrawal.

Inactivity Fees

Inactivity fees are charged if you do not use your travel card for a certain period of time. These fees can vary depending on the card issuer and the terms and conditions of your card.

Strategies for Minimizing Travel Card Fees

There are several strategies you can implement to minimize travel card fees:

- Choose a travel card with low or no fees. Many travel cards offer competitive rates and fee structures. Compare different cards before choosing one to find the best option for your needs.

- Use your travel card for large purchases only. If you plan to make several small purchases, it may be more cost-effective to use a different payment method, such as a debit card or cash.

- Avoid using your travel card to withdraw cash from ATMs. ATM withdrawal fees can be high, so it is best to use your travel card for purchases only.

- Keep track of your travel card usage. Monitor your account statements regularly to ensure that you are not being charged unnecessary fees.

Travel Card Rewards

Travel cards offer various rewards and incentives to encourage cardholders to use them for travel-related expenses. These rewards can enhance the overall value of using a travel card.

Cashback or Points on Purchases

Many travel cards offer cashback or points on every purchase made. The rewards earned can be redeemed for cash, travel credits, or other perks. Cashback cards provide a direct percentage of each purchase as a refund, while points cards accumulate points that can be redeemed for a variety of rewards.

Travel Credits

Some travel cards offer travel credits that can be used to offset the cost of travel expenses, such as flights, hotels, or rental cars. These credits can be earned through card usage or by meeting certain spending thresholds.

Elite Status and Perks

Certain travel cards offer elite status tiers that provide cardholders with exclusive benefits and perks. These perks can include priority boarding, lounge access, and complimentary upgrades. Elite status is typically achieved by meeting specific spending or travel requirements.

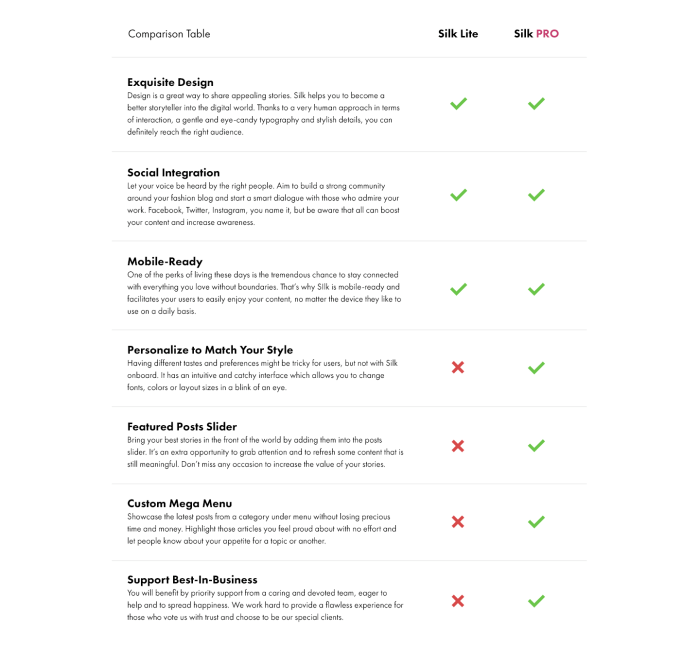

Comparison Table of Travel Card Rewards Programs

| Card | Cashback or Points | Travel Credits | Elite Status ||—|—|—|—|| Chase Sapphire Preferred | 2% cashback | $50 annual travel credit | Sapphire Preferred status || American Express Platinum | 5x points on travel, 1x on other purchases | $200 annual airline credit | Platinum status || Capital One Venture Rewards | 2 miles per dollar | 10,000 bonus miles after $10,000 in purchases | Venture status || Barclaycard Arrival Plus World Elite Mastercard | 2x miles per dollar | $400 annual travel credit | Arrival Premier status || Discover it Miles | 1.5 miles per dollar | None | None |

Travel Card Issuers

Various financial institutions offer travel cards, each with unique features and benefits. Understanding the major issuers and their offerings is crucial for choosing the right card for your travel needs.

Banks

Major banks such as Chase, Citibank, and American Express issue a wide range of travel cards. These cards often come with generous rewards programs, including bonus points for travel purchases and redemptions. They may also offer additional benefits like airport lounge access, travel insurance, and priority boarding.

Credit Unions

Credit unions, like Navy Federal Credit Union and PenFed Credit Union, offer travel cards with competitive rates and fees. These cards may have lower interest rates and annual fees compared to bank-issued cards. Additionally, credit unions often provide personalized service and local support.

Travel Agencies

Travel agencies, such as Expedia and Orbitz, also issue travel cards that cater specifically to frequent travelers. These cards often offer rewards and discounts on travel-related purchases, such as flights, hotels, and car rentals. They may also provide access to exclusive travel deals and packages.

Factors to Consider When Choosing an Issuer

- Rewards and benefits

- Fees and interest rates

- Creditworthiness requirements

- Customer service and support

- Security features

By carefully considering these factors and comparing offerings from different issuers, you can select the travel card that best aligns with your travel habits and financial goals.

Travel Card Alternatives

In addition to travel cards, there are several alternative options available for managing your finances while traveling. These include prepaid debit cards, money belts, and traveler’s checks.

Each alternative has its own advantages and disadvantages. Prepaid debit cards offer the convenience of a regular debit card, but they are not as widely accepted as travel cards. Money belts provide a secure way to store your cash, but they can be bulky and uncomfortable to wear.

Traveler’s checks are a traditional way to carry money while traveling, but they can be difficult to cash in some countries.

Prepaid Debit Cards

Prepaid debit cards are similar to regular debit cards, but they are not linked to a bank account. Instead, you load the card with money before you travel. Prepaid debit cards are widely accepted at ATMs and merchants, and they offer a convenient way to manage your spending.

However, prepaid debit cards often have higher fees than travel cards, and they may not be accepted at all merchants.

Money Belts

Money belts are a secure way to store your cash while traveling. They are worn around your waist, and they have a zippered compartment that can hold your money, passport, and other valuables. Money belts are not as convenient as travel cards or prepaid debit cards, but they offer a higher level of security.

Traveler’s Checks

Traveler’s checks are a traditional way to carry money while traveling. They are issued by banks and can be purchased in denominations of $10, $20, $50, and $100. Traveler’s checks are widely accepted at banks and merchants, but they can be difficult to cash in some countries.

Additionally, traveler’s checks often have higher fees than travel cards or prepaid debit cards.

FAQ Section

What are the key benefits of using a travel card?

Travel cards offer numerous advantages, including competitive currency exchange rates, low ATM withdrawal fees, chip and PIN technology for enhanced security, and convenient mobile app functionality for easy account management.

How do I choose the right travel card for my needs?

Consider factors such as currency conversion rates, ATM withdrawal limits, security features, mobile app functionality, and rewards programs when selecting a travel card that aligns with your travel patterns and financial goals.

What security measures are in place to protect my travel card?

Travel cards employ robust security measures such as chip and PIN technology, fraud monitoring systems, and zero liability protection, ensuring the safety of your funds and personal information.

How do I report a lost or stolen travel card?

In case of a lost or stolen travel card, immediately contact the issuing bank or credit union to report the incident. They will guide you through the process of canceling your card and issuing a replacement.

What strategies can I use to minimize travel card fees?

To minimize fees, opt for travel cards with low or no transaction fees, favorable currency conversion rates, and limited ATM withdrawal fees. Additionally, consider using your travel card primarily for large purchases and avoiding unnecessary ATM withdrawals.